Empirical Drivers and Market Performance

October 18, 2025

The Retail Renaissance: An Empirical CRE Report

Part 1: Empirical Drivers and Market Performance

Executive Summary: The Strategic Shift

The retail sector is currently undergoing a strategic renaissance, pivoting from traditional transaction-based models to a new paradigm defined by Experiential Retail and Omnichannel Integration. Far from decline, the market is demonstrating resilience and significant growth, demanding that Commercial Real Estate (CRE) professionals adapt their strategies for property valuation, leasing, and tenant selection to capitalize on these trends through Q2 2025 and beyond.

Empirical Drivers and Market Performance

Key Economic Indicators (Q2 2025)

6.7%

Retail Sector Earnings Growth

- Blended Q2 2025 estimate, LSEG (Refinitiv)

3.9%

Total Retail Sales Increase

- May-July 2025, U.S. Census Bureau

22%

Experience Conversion Growth

- Arts & Entertainment Category, Placer.ai

The Experiential Imperative: New Purpose for Physical Space

Experiential retail transforms a store from a point of transaction into a high-engagement destination, providing the fundamental justification for the in-person visit. This model is underpinned by three core principles:

- Storytelling and Brand Immersion: Spaces like the Nike House of Innovation act as interactive museums, utilizing technology to celebrate brand history and innovation, fostering deep consumer loyalty.

- Community and Connection: Retail spaces are increasingly functioning as community hubs. Lululemon, for example, integrates in-store yoga classes to build brand affinity through social engagement.

- Technology Integration: This goes beyond simple screens; it includes interactive displays, smart mirrors for product recommendation, and augmented reality (AR) features, all designed to enhance the physical browsing experience.

The Omnichannel Foundation: Seamless Customer Journey

Omnichannel integration ensures a unified, seamless customer experience across online, mobile, and in-store channels, dramatically increasing customer loyalty and lifetime value. This digital integration has profound spatial implications for CRE:

- BOPIS (Buy Online, Pick Up In-Store): This technology has fundamentally transformed stores into last-mile fulfillment centers, requiring landlords to consider new store layouts that accommodate efficient pickup zones and streamlined logistics.

- Real-Time Inventory Management: By syncing online and physical store inventory, retailers can efficiently direct customers to the nearest location with their desired item, reducing cart abandonment and driving measurable foot traffic.

- Micro-Fulfillment Centers (MFCs): The integration of small-scale fulfillment centers within physical stores is rising. This hybrid model allows for rapid local delivery and maximizes efficiency, fundamentally influencing the design and location requirements for new retail properties.

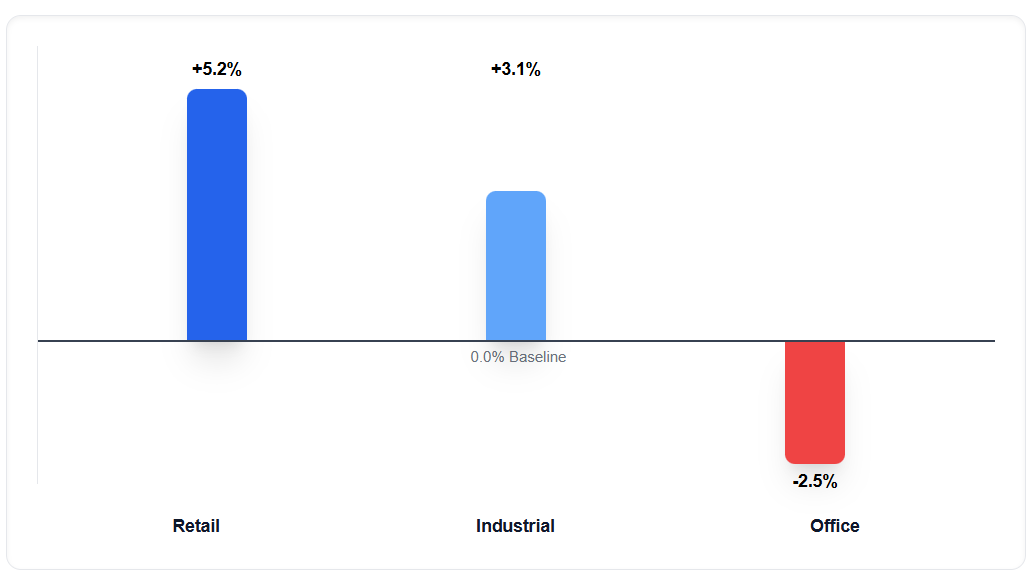

CRE Market Performance (Q1 2025 Valuation Growth)

The chart below visualizes data from a Q1 2025 U.S. Commercial Real Estate Transactions report by Altus Group, clearly highlighting the Retail sector’s measurable outperformance compared to Industrial and Office assets, affirming the success of this strategic renaissance.

Empirical Data Sources

The conclusions in this report are grounded in proprietary and external industry data, including:

- LSEG (Refinitiv) – Q2 2025 U.S. Retail Preview

- U.S. Census Bureau – Monthly Retail Trade Report

- Placer.ai – Q2 2025 Retail Foot Traffic Analysis

- Altus Group – Q1 2025 U.S. Commercial Real Estate Transactions

- J.P. Morgan – 2025 Commercial Real Estate Midyear Outlook

- Crow Holdings – 2025 Real Estate Outlook

- Cushman & Wakefield – Midpoint 2025 U.S. Economic & CRE Outlook

- NORR – Eight Principles of Experiential Retail Design

- SCAYLE – Omnichannel Technologies